October 13, 2022 | Made in California, Innovation & Growth

5 Statistics That Show California Manufacturing is Alive and Well

The pandemic's impact on labor and supply chains contributed to the false notion that California‘s manufacturing industry is declining, but the Golden State’s output has exceeded national averages by 83% since the 1990s. And statistics for overall production, high-tech manufacturing, and sector niches demonstrate that California is a national leader.

While manufacturing jobs in the state have steadily dropped from 15.6% to 7.7% over the last 30 years, manufacturing output has increased by 72%. This dichotomy is being driven by increases in labor productivity, particularly in high-tech and durable goods manufacturing, which has become increasingly capital intensive. Increases in labor productivity over this period reveal the extent to which manufacturers are innovating production equipment and manufacturing processes, investing in new technology, and developing high-skilled employees. In fact, each hour of manufacturing labor today produces twice the value of output that it did in 1990.

Let’s look at five data points from California’s Manufacturing Industries Employment and Competitiveness Study, a new report produced by Beacon Economics LLC and commissioned by CMTC, that reinforce California's leading position.

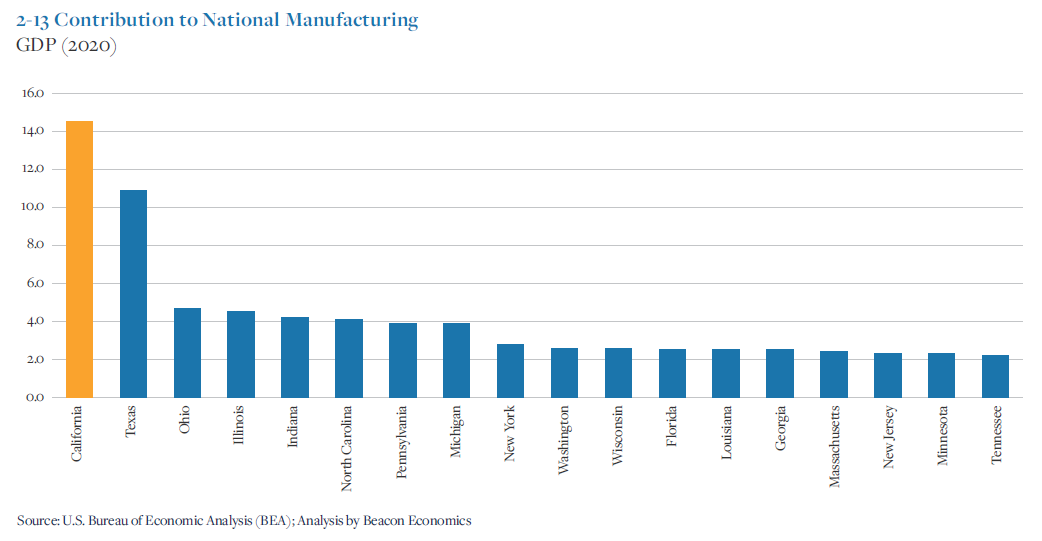

1. California Accounts for 14.5% of U.S. Manufacturing Output

California is still the largest contributor to the U.S. manufacturing industry – both in terms of output and employment. The productivity growth in the state’s manufacturing sector has eclipsed the performance of the industry nationally by more than 80% since the 1990s.

Strictly looking at output, after Texas in second place, every other state is roughly 10 points behind or more. Further, California’s sector has grown 4% since 2000, despite reports of that year initiating a “Lost Decade” in American manufacturing.

As one of the largest states, some may misinterpret the data as inflated by California's extensive geographic size and U.S.-leading population base. Yet the size and population of the next-highest five states (after California and Texas) in U.S. manufacturing output are:

- Ohio: 7th in population; 34th in size

- Illinois: 6th in population; 25th in size

- Indiana: 17th in population; 38th in size

- North Carolina: 9th in population; 28th in size

- Pennsylvania: 5th in population; 33rd in size

There's a minor correlation between population size and output, but not one significant enough to explain California's lead. The state boasts a massive advantage independent of its people or space, with its high-value, high-tech manufacturing sector.

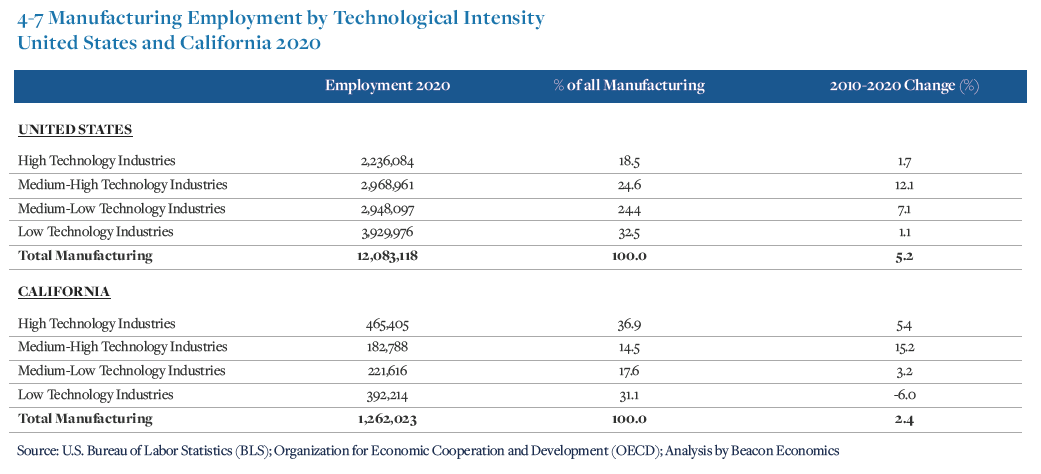

2. 62% of Jobs Are in High and Medium-High Tech Industries

The major driver for California’s 40% output growth over the previous three decades has been transitioning from low technology to high- and medium-high technology industries. Today, that transition’s success is demonstrated by high tech and medium-high tech manufacturing comprising 62% of statewide sector employment. High tech manufacturing alone amounts to 36.9% of statewide sector employment, doubling the national average.

High technology manufacturing refers to the direct incorporation of advanced technology within more sophisticated production processes. Examples include the complex techniques used to produce aerospace materials, pharmaceuticals, and precision instruments. In contrast, low technology manufacturing describes the production of goods like textiles, food products, and cut and sew apparel.

Underlying the transition is R&D investment, artificial intelligence, expanded worker upskilling, and improved safety. With high and medium-high tech manufacturing growing at the expense of its low-tech counterpart, the impact of worker training is evident. And, as a result, these employment statistics illustrate California’s preparedness to continue leading the economy into manufacturing’s future and what’s become known as “Industry 4.0.”

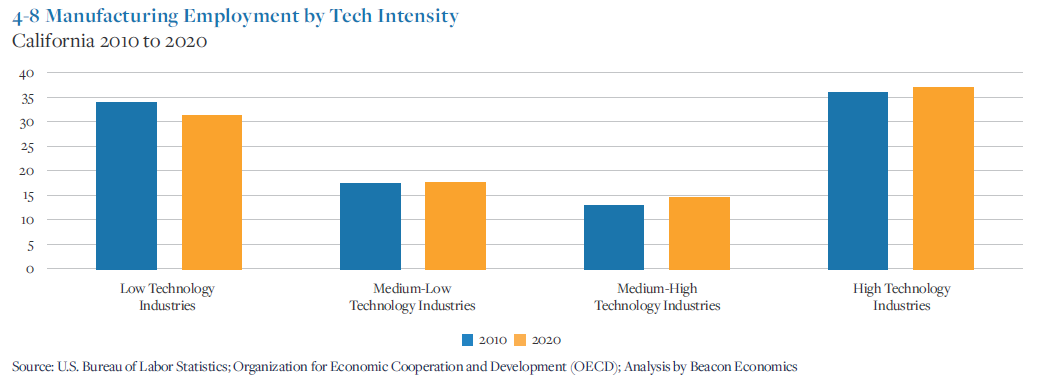

3. High Tech Employment Increased by 5.4% In 10 Years

We can definitively see California’s transition to high tech and medium-high tech manufacturing over time within the reported data. Between 2010 and 2020, high and medium-high tech manufacturing in California saw employment growth rates of 5.4% and 15.2%, respectively. By comparison, low tech manufacturing sits just beneath U.S. averages and has decreased by 6% within California over the last decade.

These trends are crucial because they demonstrate California’s ability to remain a leader as the broader manufacturing industry makes strides in the future of its technology. They also indicate better job security and economic resilience for workers. California’s overall competitiveness in training and retaining highly skilled workers has been and will remain critical to continued growth and success.

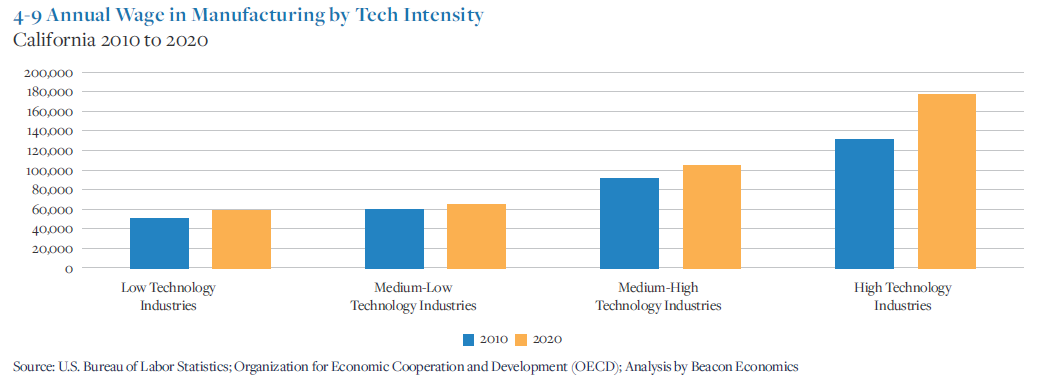

4. Wages for High Tech Jobs Increased by 35% In 10 Years

The report’s findings clearly illustrate the competitiveness of California’s employee retention rate. By 2020, the average compensation of highly skilled workers in the high tech manufacturing sector had increased from $130,000 to almost $180,000.

Better pay increases employee satisfaction and keeps skilled and knowledgeable workers in California. It also attracts new workers to the state which benefits the broader state economy.

Companies in the high tech manufacturing sector tend to match compensation to inflation rates, keeping their workers’ pay at (or above) market rates. And, when it comes to raising wages, high tech companies have performed better than their low tech counterparts over the last ten years.

5. California Dominates Important Manufacturing Niches

%20Chart.png?width=555&name=5-3%20Aerospace%20Vehicles%20and%20Defense%20Industry%20Cluster%20California%20(2010-2020)%20Chart.png)

Approximately 16% of all aerospace manufacturing jobs and 28% of all IT and analytical product manufacturing jobs in the U.S. are accounted for by the state of California. These industries provide reliable indicators for both high tech manufacturing and the continued development of technologies that will usher in Industry 4.0.

Even with employment and competitiveness losses in the 1990s and early 2000s, aerospace manufacturing remains a relatively strong sector in California. It maintained an industry growth of 7% between 2010 and 2020, employing over 100,000 highly-paid workers at the decade’s close. Moreover, as aerospace companies continue to increase their California presence, we may see a return to the sector's defense spending.

The information technology (IT) and analytical products manufacturing industry in California — employing over 243,600 highly-paid workers — is another to watch for its broader impact. This subsector’s output directly contributes to providing advanced technologies for high tech manufacturing.

By keeping the transformative IT and analytical product industry in the state, California provides its other manufacturers with the best access and talent for R&D. These manufacturers are also positioned to benefit from national and international adoption of Industry 4.0 shifts as a leading supplier of technologies and innovation.

How CMTC Helps California SMMs Innovate and Grow

CMTC has a deep understanding of the constantly evolving environment small and medium-sized manufacturers (SMMs) face in the state of California. With a proven reputation as a "trusted advisor," CMTC’s mission is to improve the productivity and global competitiveness of California’s SMMs, providing a broad array of innovative services that help CA SMMs thrive in today's economy. To learn how CMTC can help you innovate and grow your business, contact us today.

To discover more key findings and data from CMTC’s recent employment and competitiveness study, download our free California manufacturing study infographic!

About the Author

Gregg Profozich

Gregg Profozich is a manufacturing, operations and technology executive who believes that manufacturing is the key creator of wealth in the economy and that a strong manufacturing sector is critical to our nation’s prosperity and security now, and for future generations. Across his 20-year plus career in manufacturing, operations and technology consulting, Mr. Profozich helped manufacturing companies from the Fortune 500 to the small, independents significantly improve their productivity and competitiveness.